|

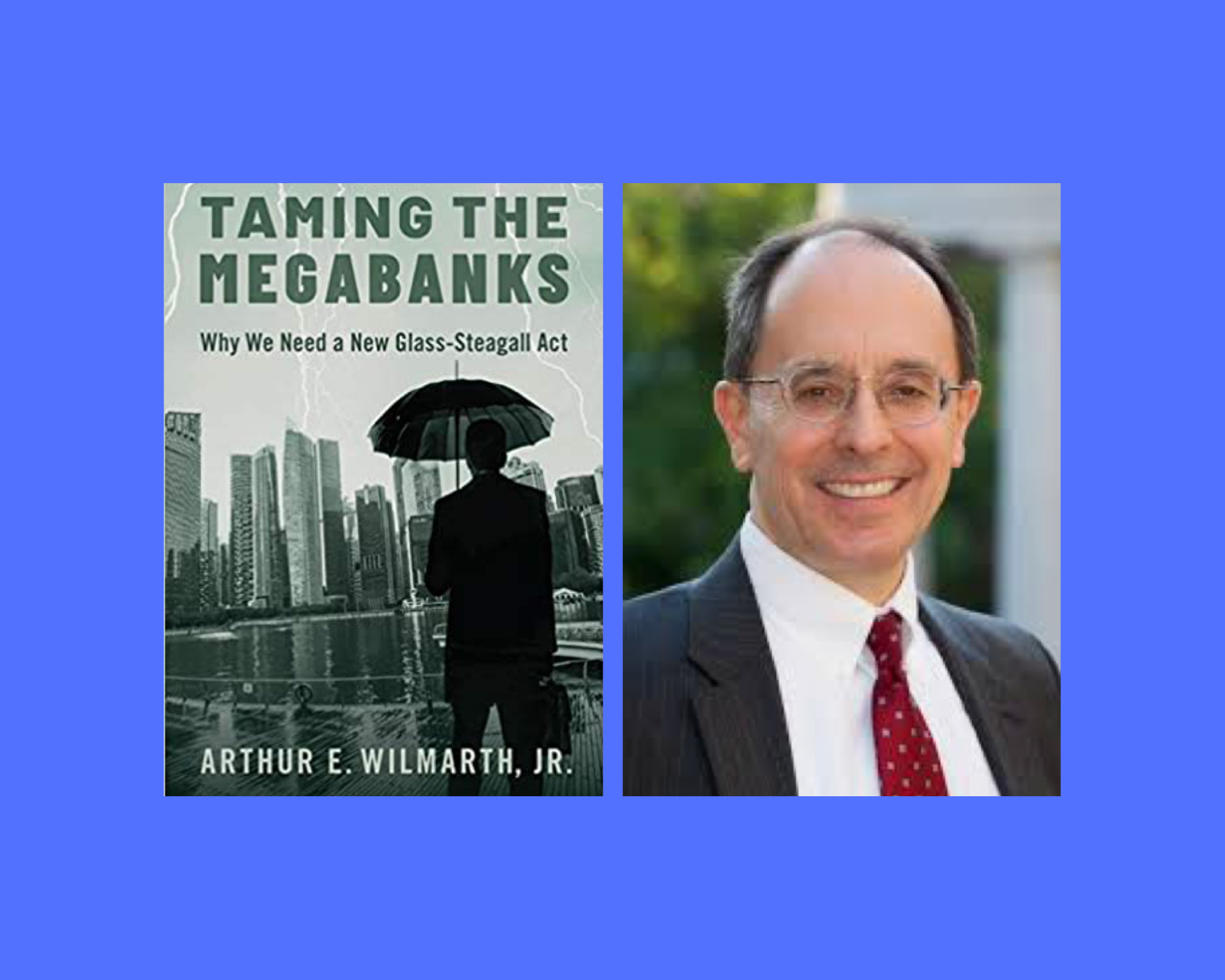

Taming the Megabanks: Why We Need a New Glass-Steagall Act with Arthur Wilmarth, ES '72

Thursday, February 04, 2021, 6:30 PM - 7:30 PM EDT

Category: Events

|

|

|

Yale Club of DC Virtual Event

Taming the Megabanks:

Why We Need a New Glass-Steagall Act

with Arthur Wilmarth '72

Thursday, February 4, 2021

6:30-7:30pm

This meeting will be conducted on Zoom. Instructions will be provided upon registration

|

The Yale Club of Washington, D.C. invites you to join us for a conversation with George Washington University Law School Professor Emeritus Arthur Wilmarth, ES '72, for a discussion about his recent book, Taming the Megabanks: Why We Need a New Glass-Steagall Act. In his book, Wilmarth's comprehensive and detailed analysis demonstrates that a new Glass-Steagall Act would make our financial system much more stable and less likely to produce boom-and-bust cycles. Giant universal banks would no longer dominate our financial system or receive enormous subsidies.

About the Discussion

Banks were allowed to enter securities markets and become universal banks during two periods in the past century - the 1920s and the late 1990s. Both times, universal banks made high-risk loans and packaged them into securities that were sold as safe investments to poorly-informed investors. Both times, universal banks promoted unsustainable booms that led to destructive busts - the Great Depression of the early 1930s and the Global Financial Crisis of 2007-09. Both times, governments were forced to arrange costly bailouts of universal banks.

Congress passed the Glass-Steagall Act of 1933 in response to the Great Depression. The Act broke up universal banks and established a decentralized financial system composed of three separate and independent sectors: banking, securities, and insurance. That system was stable and successful for over four decades until the big-bank lobby persuaded regulators to open loopholes in Glass-Steagall during the 1980s and convinced Congress to repeal it in 1999.

Congress did not adopt a new Glass-Steagall Act after the Global Financial Crisis. Instead, Congress passed the Dodd-Frank Act. Dodd-Frank's highly technical reforms tried to make banks safer but left in place a dangerous financial system dominated by universal banks. Universal banks continue to pose unacceptable risks to financial stability and economic and social welfare. They exert far too much influence over our political and regulatory systems because of their immense size and their undeniable "too-big-to-fail" status.

In Taming the Megabanks, Arthur Wilmarth argues that we must again separate banks from securities markets to avoid another devastating financial crisis and ensure that our financial system serves Main Street business firms and consumers instead of Wall Street bankers and speculators. Wilmarth's comprehensive and detailed analysis demonstrates that a new Glass-Steagall Act would make our financial system much more stable and less likely to produce boom-and-bust cycles. Giant universal banks would no longer dominate our financial system or receive enormous subsidies. A more decentralized and competitive financial system would encourage banks and securities firms to fulfill their proper roles as servants - not masters - of Main Street businesses and consumers.

For those who would be interested in purchasing the book, please see here:

Support the Yale Club of Washington, DC

The Yale Club of Washington, DC offers this event at no cost to our members and alumni. However, we do ask for your support in one or both of the following ways:

1) Please become a member if you are not one already.

2) Donate to the Yale Club of Washington, DC (see option on registration page).

Membership dues and donations are both critical income sources for the Club, which enable Club operations, programs, and financial viability.

|

Contact: Lauren Harris - [email protected]

|